Malaysia Rental Income Tax Deductible Expenses

Rental income is assessed on a net basis.

Malaysia rental income tax deductible expenses. Keep all business records supporting documents for deductions reliefs and rebate for a period of 7 years. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Essentially the law states that an an expense wholly and exclusively incurred in the production of income under subsection 33 1 of the income tax act ita 1967 and which is not prohibited under subsection 39 1 of the ita is allowed as a deduction. The letting of the office units is treated as a non business source of yes.

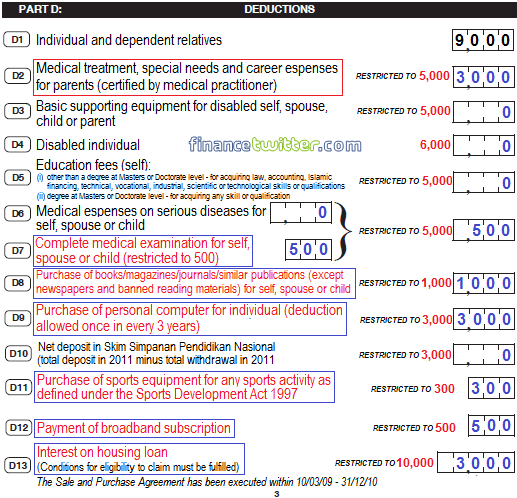

Examples of such expenses are as follows assessment and quit rent interest on loan and fire insurance premium expenses on rent collection expenses on rent renewal expenses on repair and service charges. To submit the income tax return form by the due date. When computing the rental gain to be disclosed in tax filings the gross rental income can be reduced by permitted expenses incurred. Property owners who lease their residential properties can now enjoy the convenience of pre filled rental expenses.

Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Chances are the portion of adam s tax on his rental income would be 24 or 24 5 if he chooses his income to be taxed individually and he has little personal reliefs on his income tax. Expenses which are allowed deduction from rental income are the direct expenses that are wholly and exclusively incurred in the production of the rental income.

Let us assume adam earns himself a net rental income of rm 5 000 a month after deduction of allowable expenses his total monthly income would be rm 25 000 a month or rm 300 000 a year. Individuals need to. All supporting documents like business records cp30 and receipts need not be submitted with form p. Posted in uncategorized on dec 05 2019.

In malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d rental income of the income tax act 1967. Income received from the letting is charged to tax as rental income under paragraph 4 d of the ita. Therefore the taxpayer will have to fall back on the letter of the law to determine if an expense is tax deductible against rental income.